Which Of The Following Types Of Income Is Subject To Self Employment Tax are a necessary resource for learning, arranging, and innovative tasks. Whether you're a teacher, parent, or pupil, these ready-to-use resources save effort and time. From instructional worksheets for math, science, and grammar to imaginative templates like planners, calendars, and coloring web pages, there's something for everyone. With the comfort of printable layouts, finding out and efficiency can be improved in your home or in the class.

Check out a variety of adjustable designs that accommodate numerous needs and ages. These templates make discovering interactive and enjoyable while advertising creative thinking. Download and install, print, and start utilizing them today!

Which Of The Following Types Of Income Is Subject To Self Employment Tax

Which Of The Following Types Of Income Is Subject To Self Employment Tax

Perimeter worksheets 3rd grade involve questions on calculating the perimeter of different shapes such as square rectangle and triangle and even complex figures like parallelogram rhombus etc Third-grade students begin to learn about the foundations of geometry, including perimeter. This collection of geometry worksheets walks students through educator-created word problems and exercises about how to calculate the perimeter for different shapes.

3rd Grade Area And Perimeter Worksheets

What Is The Self Employment Tax Which Deductions Can You Take TheStreet

Which Of The Following Types Of Income Is Subject To Self Employment TaxThese worksheets is specially designed for Grade 3 to Grade 5. This page includes perimeter of triangle, perimeter of square and perimeter of rectangle. Different set of problems are available here for students. Equip students of grade 3 through grade 8 with the best source of printable perimeter worksheets to strengthen their practice The step by step approach assists students in mastering the concept with ease

Perimeters of rectangles worksheets. Students are given the width and length of rectangles and are asked to find the rectangle's perimeter in standard or metric units. Grade 3 | Geometry | Free | Printable | Worksheets. Solved Problem 13 18 LO 2 Penguin Corporation a Cash Chegg Solved An Inexperienced Accountant For Sunland Corporation Chegg

Printable 3rd Grade Perimeter Worksheets Education

Are Board Of Directors Fees Subject To Self Employment Tax

Go ahead and download or print our area and perimeter worksheets Grade 3 for your next class We craft each worksheet to be mentally engaging and visually appealing to your learners to help them get into the optimal mood for studying their geometry topics in Grade 3 Quizzer 2 Withholding Taxes Final Tax On Passive Income Statement

Free Printable and Online Worksheets with answers How to find the perimeter of a rectangle or a regular shape Perimeter word problems suitable for third grade or grade 3 Free Practice Math Worksheets to be printed pdf or practice online Different Ways To Earn Income Income Tax

Definition Financial Literacy Income Media4Math

Are Trustee Fees Subject To Self Employment Tax

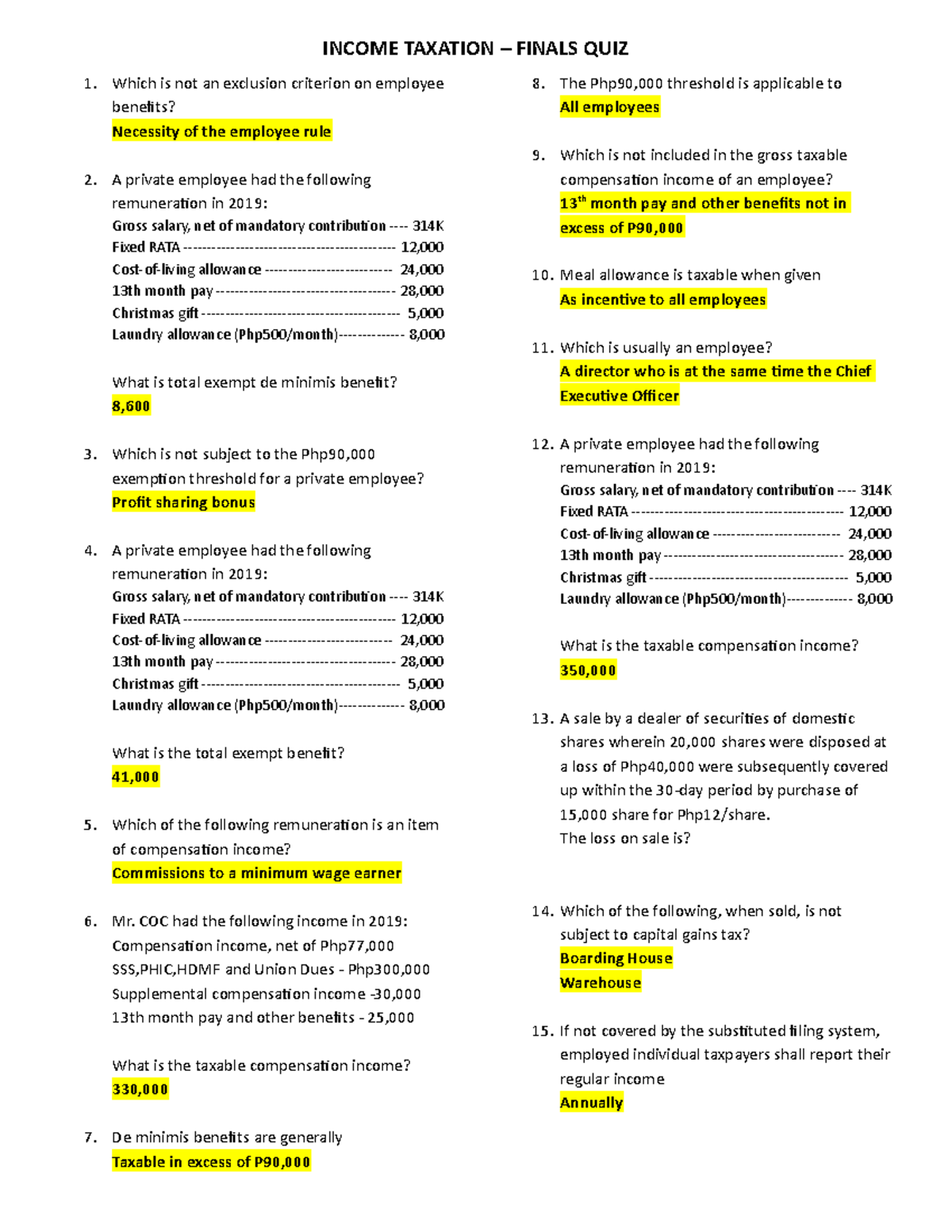

Income Taxation Finals Quizzes Which Is Not An Exclusion Criterion

10 Types Of Income Streams Ultimate Guide Start Passive Income

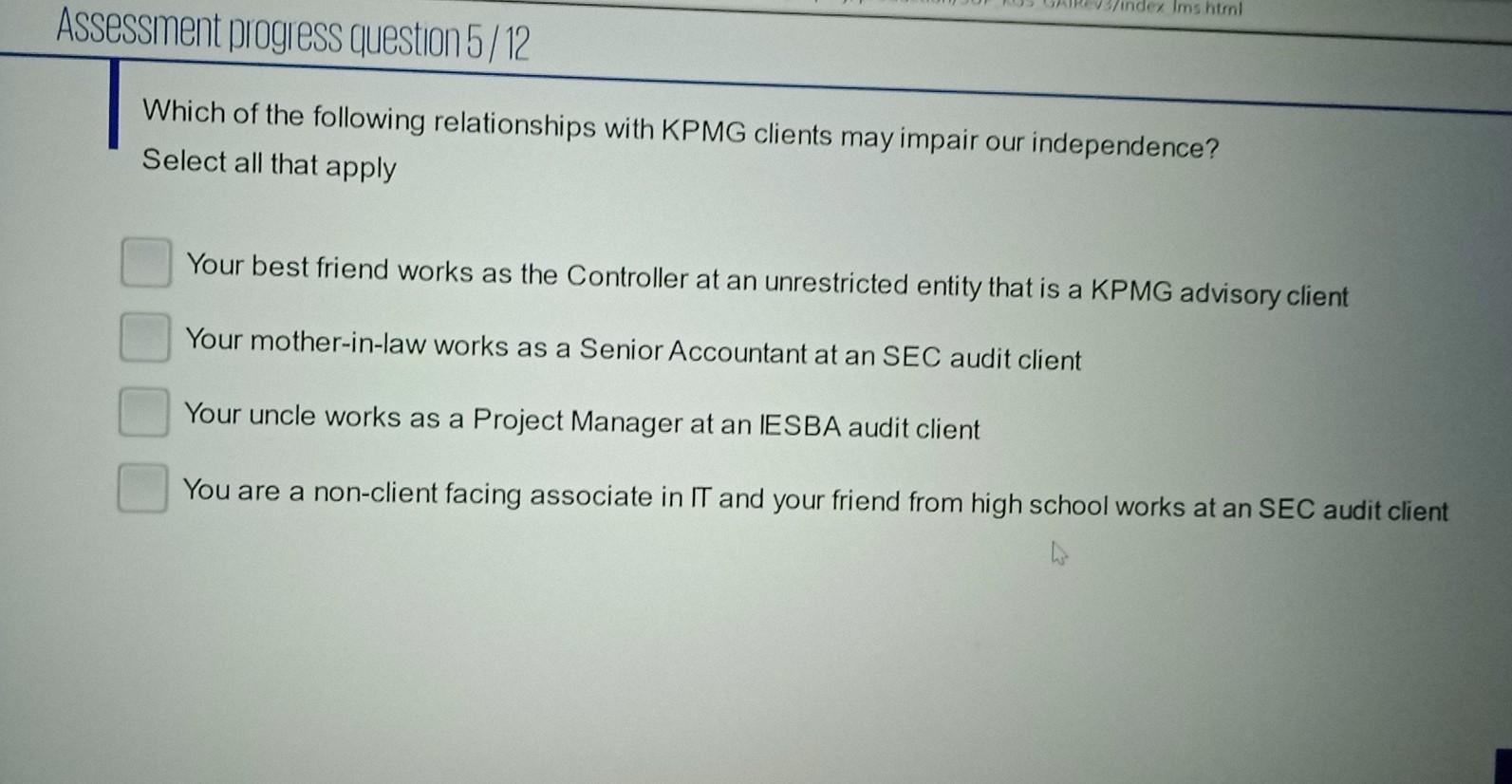

Solved Which Of The Following Relationships Wit

Understanding The Self Employment Tax

Tax Basics Self Employment Tax Workful Your Small Business Resource

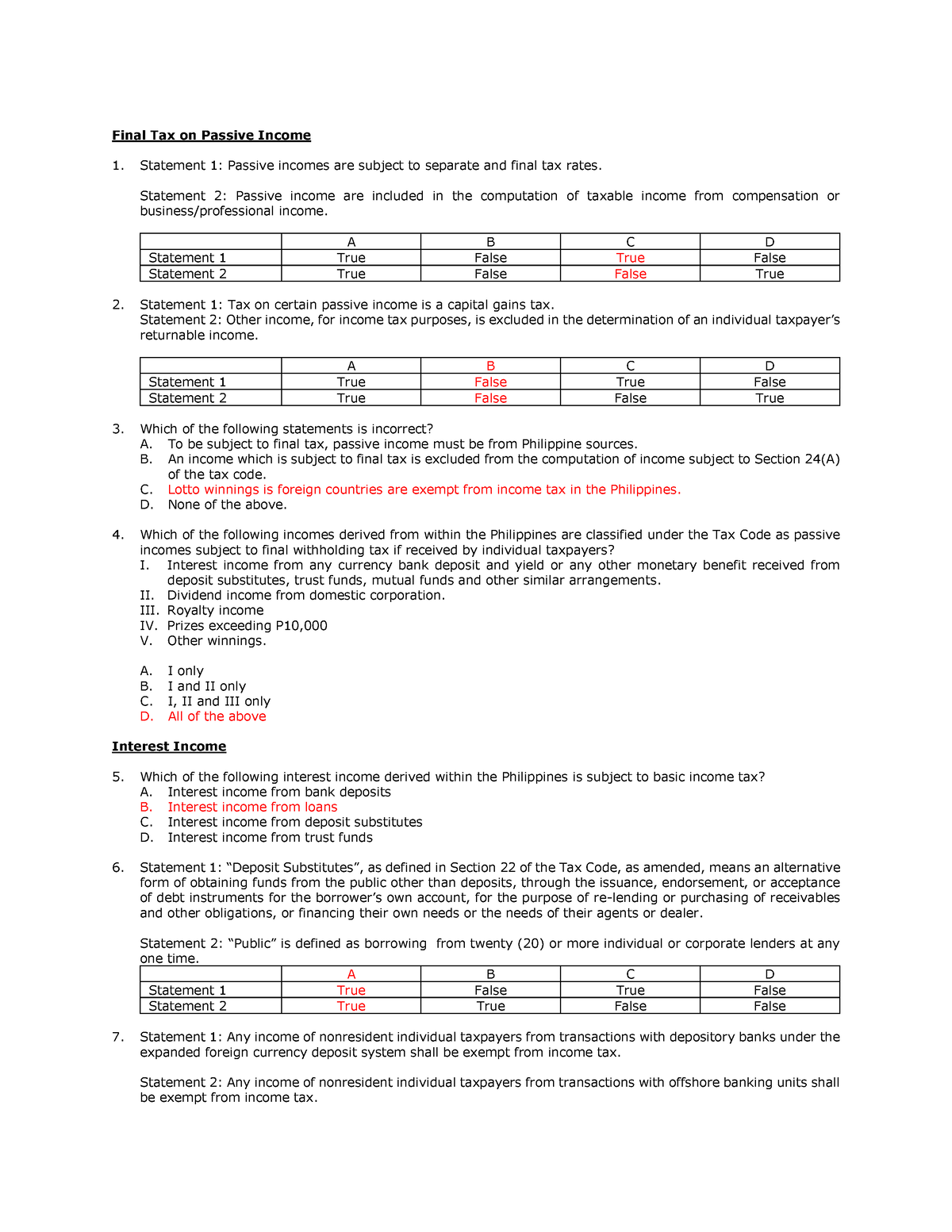

Quizzer 2 Withholding Taxes Final Tax On Passive Income Statement

Income Verification Letter 2024 guide Free Samples Sheria Na Jamii

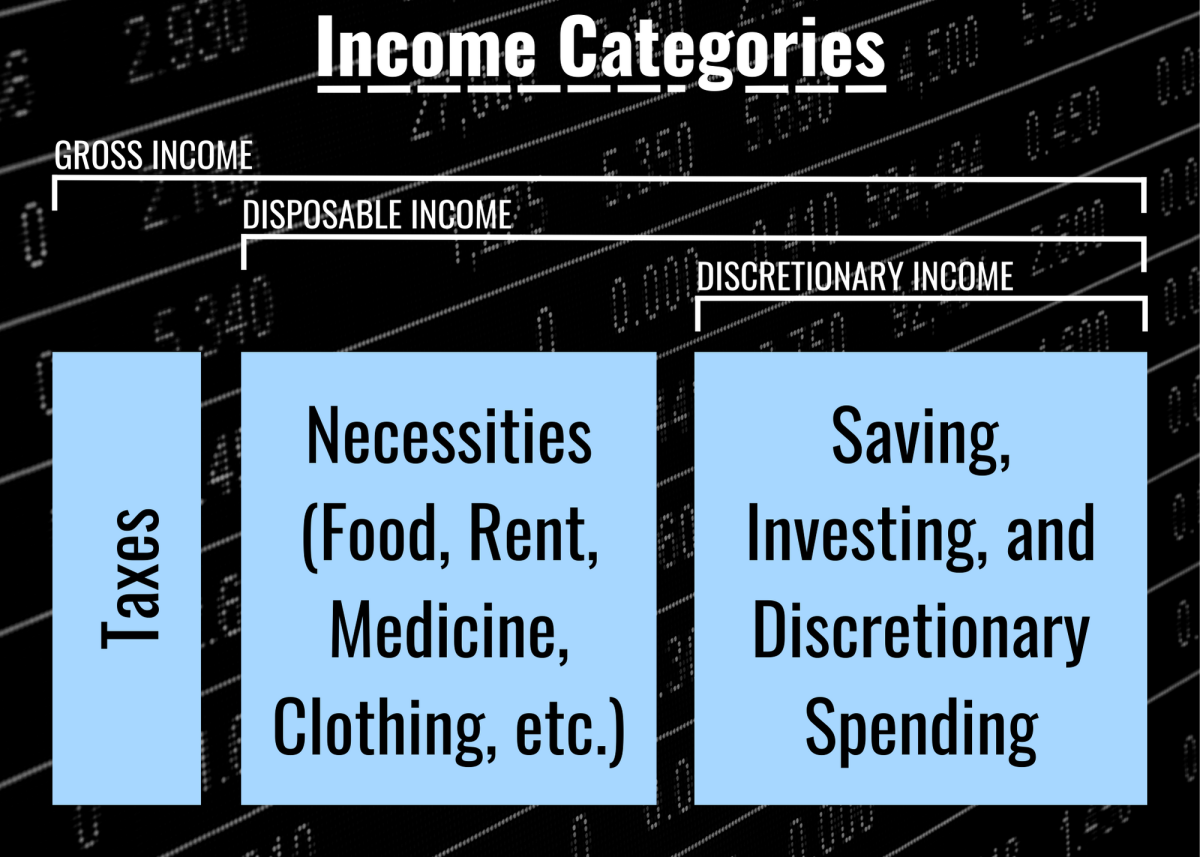

What Is Disposable Income Definition Importance In Personal Finance