What Tax Form For Self Employed are an essential source for understanding, organizing, and creative activities. Whether you're an educator, moms and dad, or trainee, these ready-to-use resources conserve time and effort. From academic worksheets for math, scientific research, and grammar to creative templates like planners, calendars, and coloring web pages, there's something for everyone. With the ease of printable styles, finding out and performance can be enhanced in your home or in the classroom.

Discover a large range of personalized layouts that deal with numerous needs and ages. These templates make discovering interactive and fun while advertising creativity. Download, print, and start utilizing them today!

What Tax Form For Self Employed

What Tax Form For Self Employed

These free worksheets explore how to determine the meaning of words that have multiple definitions This FREE vocabulary unit provides a variety of ways to work on multiple meaning words or homonyms. It's perfect for upper elementary, middle school, or high ...

Multiple meaning words worksheet hammouti Amazon

Tax Return Self Employed Grant Employment Form

What Tax Form For Self EmployedInstantly access Twinkl's printable and digital K-12 teaching resources, including worksheets, eBooks, games, PowerPoints, Google Slides, and more! This no prep worksheet was created to help students practice their multiple meaning goals This product can be printed in color or black

These no prep workbooks will challenge your students with options that include sentence completion, choosing correct usage, and composing original sentences. Form For Self Employed Taxes Employment Form 1099 Forms Printable Printable Forms Free Online

Free multiple meaning words in sentences TPT

Schedule Se Tax Form 2024 Carry Crystal

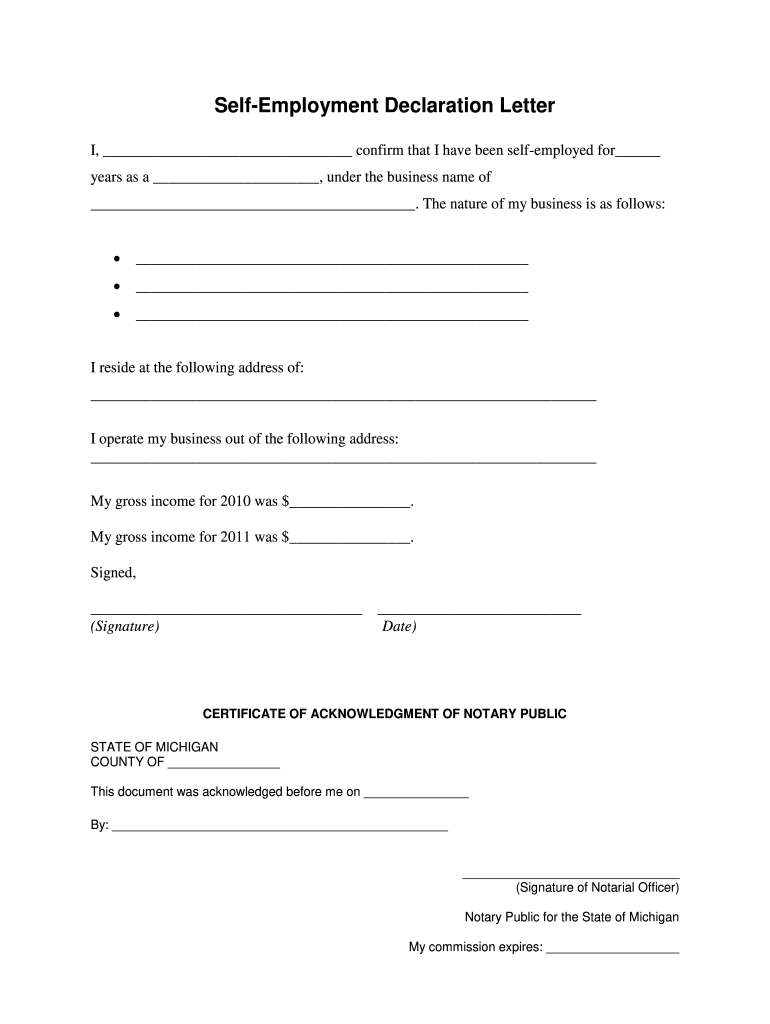

This comprehensive collection of 15 worksheets on multiple word meanings provides students with an enriching and interactive way to explore the complexities of Self Employed Income Declaration Form Employment Form

In these worksheets students identify two meanings for each homonym These worksheets are available to members only Self Employed Earnings Declaration Form Employment Form 2022 Self Employed Tax Form Employment Form

Self employed Tax Made Easy TaxScouts

Realtor Tax Deduction List

Self Employed Form Illinois Employment Form

Cheapest Tax Service For Self Employed News Week Me

Tax Planning NumberSquad

Self Employment Tax Guide For Online Sellers Tax Hack Accounting Group

Self Employed Canada Tax Form Employment Form

Self Employed Income Declaration Form Employment Form

Tax Form For Self Employed Individuals

A List Of Itemized Deductions