What Are Self Employment Tax Forms are an important resource for learning, organizing, and creative activities. Whether you're a teacher, parent, or student, these ready-to-use resources conserve time and effort. From instructional worksheets for mathematics, science, and grammar to creative templates like planners, calendars, and coloring web pages, there's something for everyone. With the convenience of printable styles, learning and performance can be improved in the house or in the class.

Discover a vast array of adjustable designs that cater to numerous requirements and ages. These templates make finding out interactive and enjoyable while advertising imagination. Download, print, and begin using them today!

What Are Self Employment Tax Forms

What Are Self Employment Tax Forms

This topic will help students learn the relationship between multiplication operations and the concept of scaling Have students categorize statements about multiplication as scaling in this interactive activity.

5nf5b Interpret multiplication as scaling resizing by Sort By Grade

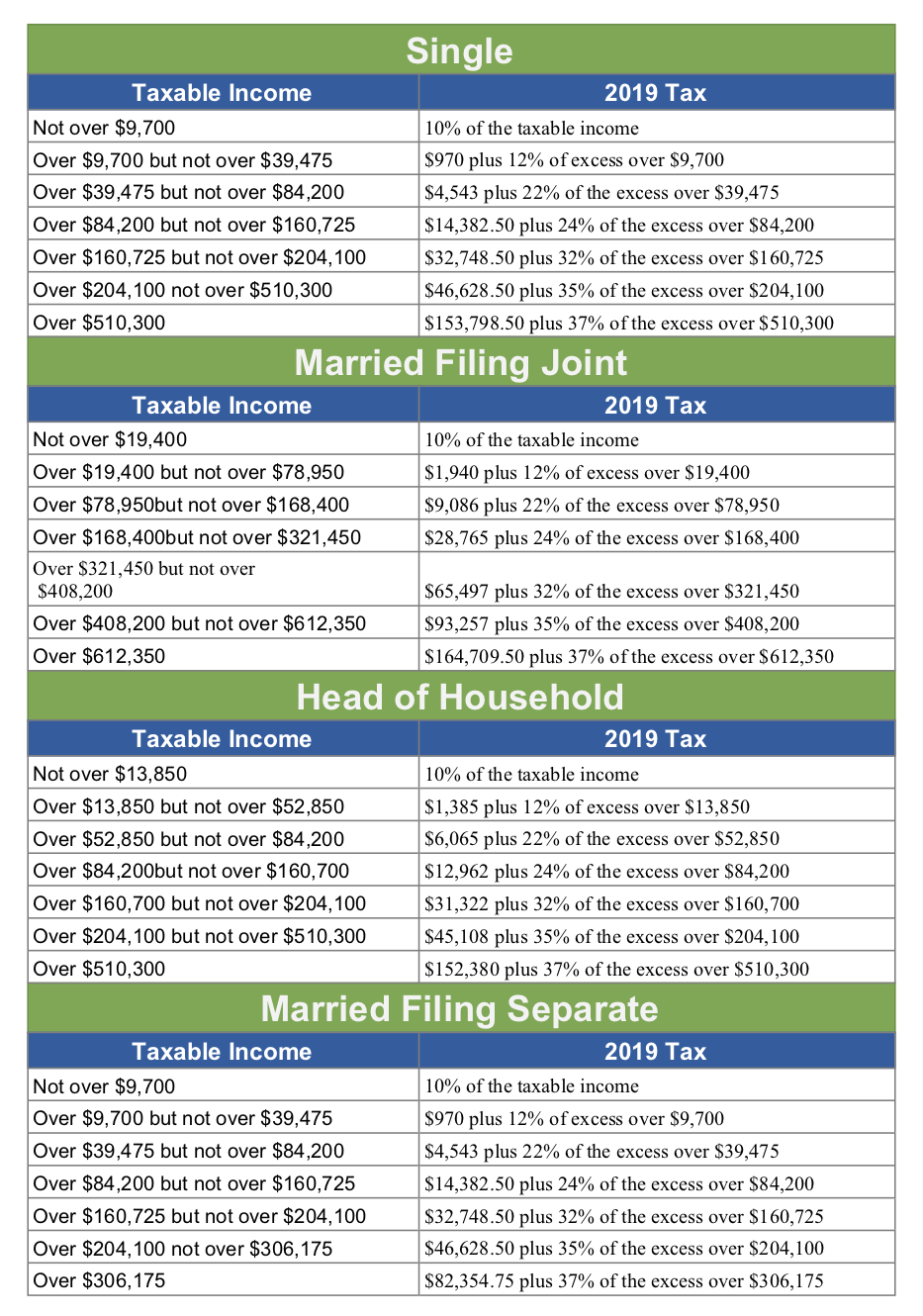

2024 Tax Forms Ontario Fanya Jeannette

What Are Self Employment Tax FormsImprove your math knowledge with free questions in "Scaling fractions by fractions" and thousands of other math skills. Standard 5NF B 5 Interpret multiplication as scaling resizing Objective Use number sense to determine whether the product of a number

Test your knowledge of fraction multiplication with this essential fifth-grade worksheet! Download to complete online or as a printable! 2005 Self Employment Tax Form Employment Form 20 Car And Truck Expenses Worksheet Worksheets Decoomo

Always Sometimes and Never Multiplication Scaling Worksheet

Self Employed Tax Credits 2024 Elsi Nonnah

Fun worksheets to practice multiplication as scaling with your 5th graders These 8 worksheets can be used as homework independent practice or centers in 2025 W2 Changes Walter K Blake

Explore our scaling fractions worksheets for elementary grades covering multiplying fractions simplifying and more Download for free Self Employed Tax Calculator 2025 Mary M Jeter When Can I Submit My 2023 Tax Return Printable Online

Self Employed Tax 2024 Alys Lynnea

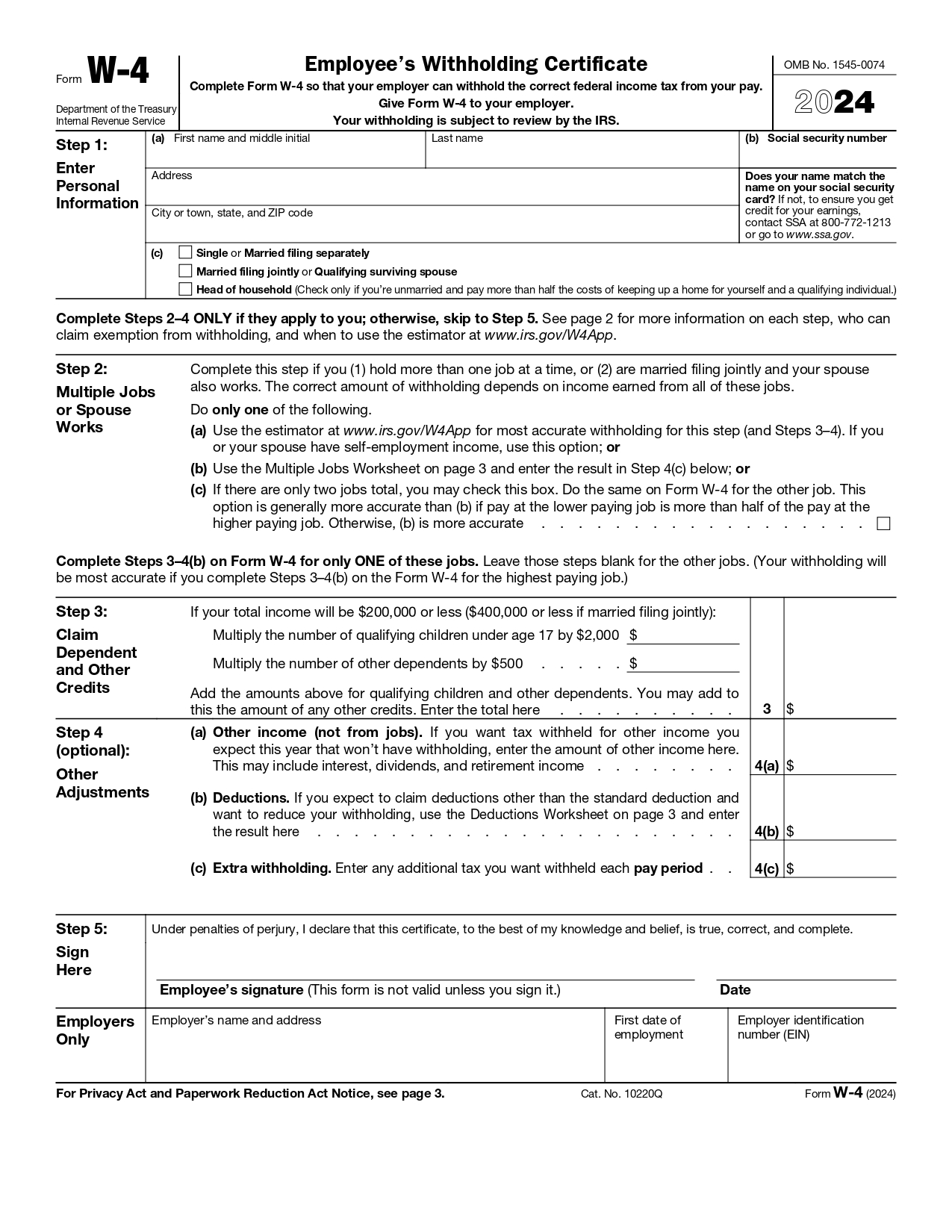

2024 W 4 Forms Printable Lita Wendye

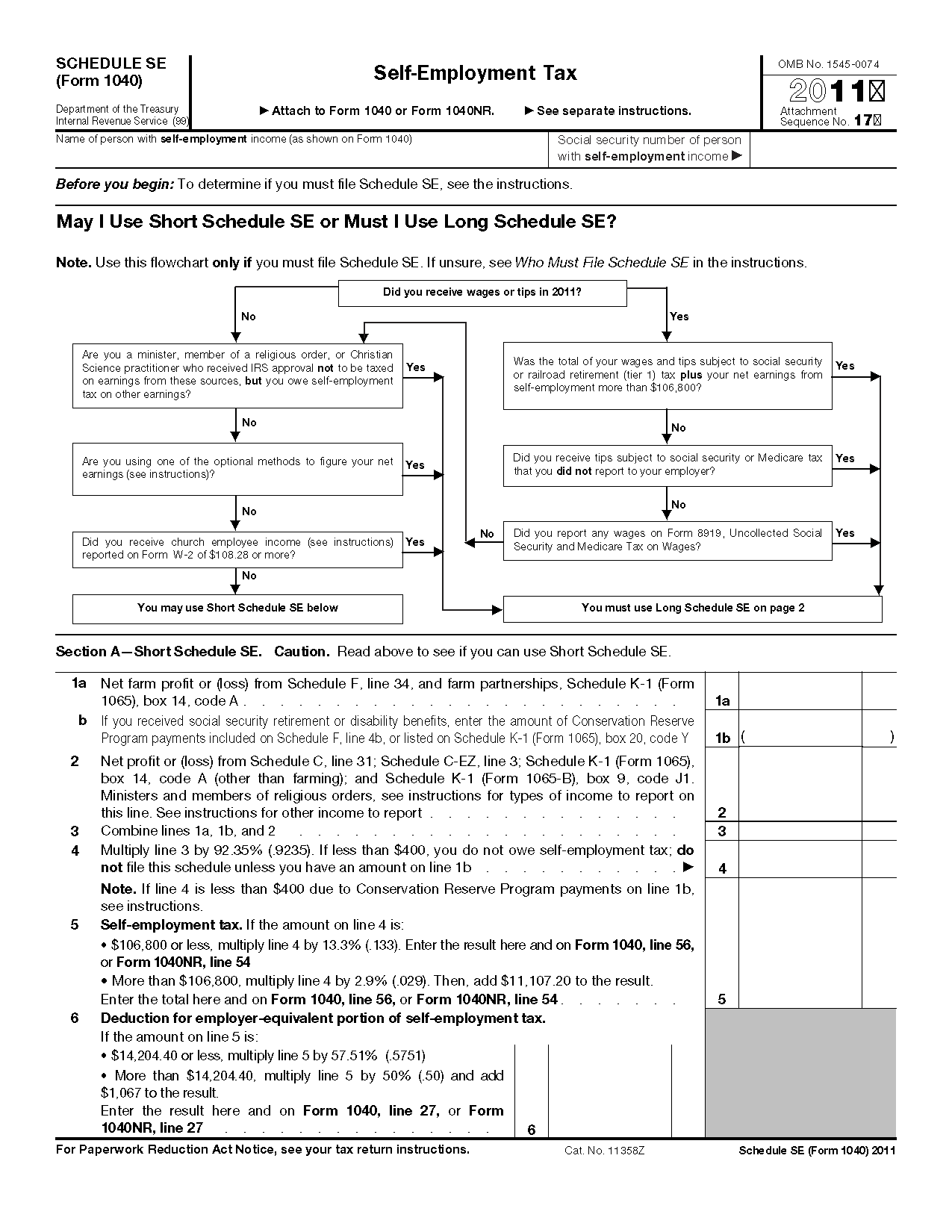

Self Employment Tax Guide For Online Sellers Tax Hack Accounting Group

2024 Self Employment Tax Form Brita Fenelia

Irs Schedule Se 2024 Calculator Gayel Gilligan

Self Employment Report Form Employment Form

![]()

W2 2025 Form Printable Pdf Jerry M Gulley

2025 W2 Changes Walter K Blake

1040 Form 2025 Instructions Allen A McDonald

W 9 Form 2025 Printable Irs Beverly Edwards