How To Count Money Bills are a vital source for understanding, organizing, and creative activities. Whether you're a teacher, parent, or pupil, these ready-to-use resources save effort and time. From academic worksheets for math, scientific research, and grammar to creative templates like planners, calendars, and coloring pages, there's something for every person. With the convenience of printable layouts, learning and productivity can be boosted at home or in the class.

Check out a wide range of adjustable designs that satisfy numerous demands and ages. These templates make finding out interactive and enjoyable while advertising creative thinking. Download, print, and start utilizing them today!

How To Count Money Bills

How To Count Money Bills

How to figure your gain or loss worksheet walkthrough IRS Publication 523 Selling Your Home 1 4K views1 year ago more This publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. It also shows you how to do the calculations you' ...

How to Calculate Your Capital Gain Exclusion When YouTube

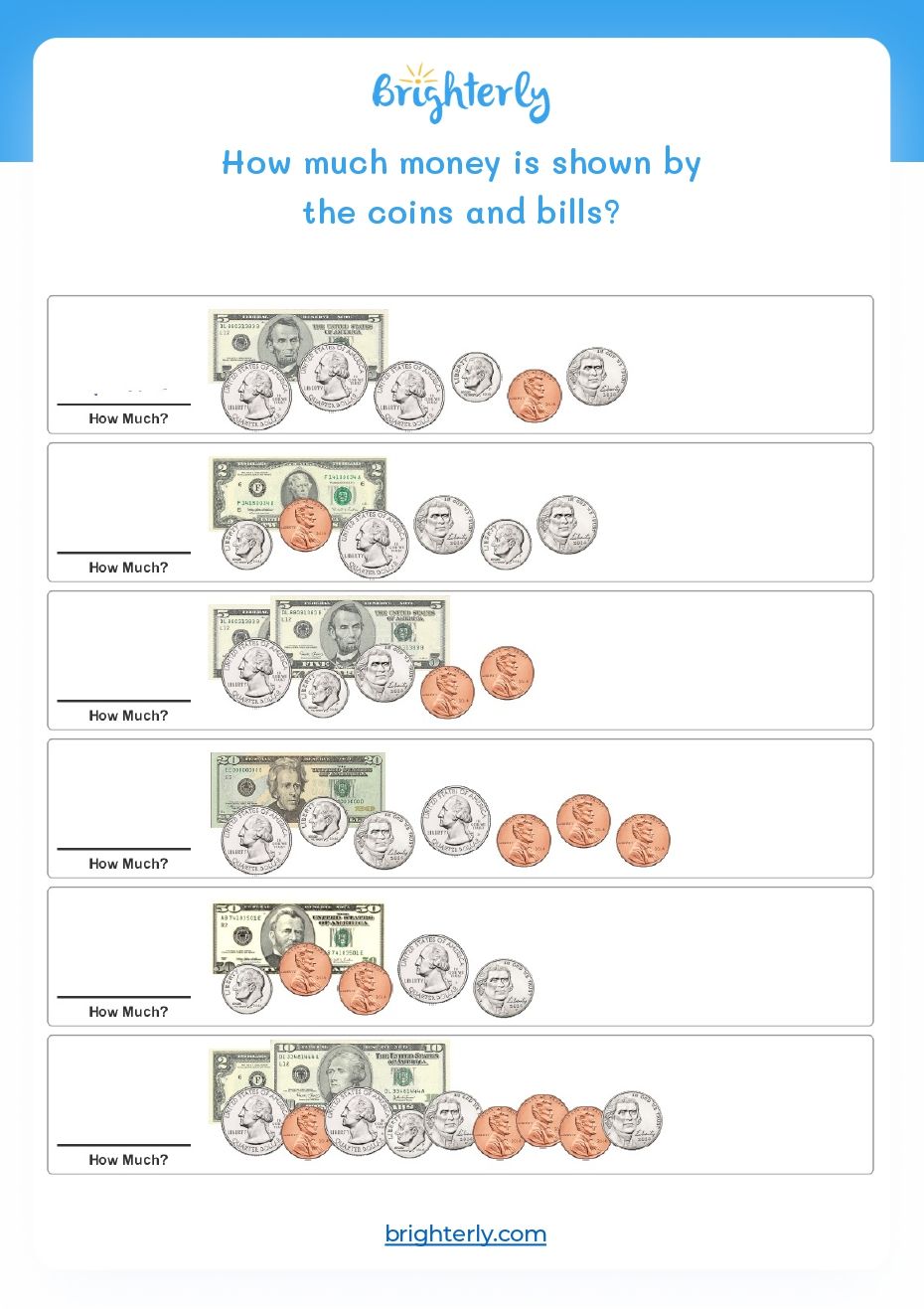

Philippine Money Money Worksheets Money Math Worksheets Money Math

How To Count Money BillsOn Worksheet 2 line 5l enter the postponed gain from the last Form 2119 that you filed, which would be for the last home that you sold prior to May 7, 1997. This publication also has worksheets for calculations relating to the sale of your home It will show you how to Figure your maximum

This publication includes worksheets and instructions to help homeowners navigate tax reporting requirements. Get IRS Publication 523 Form. Edit, Download ... Counting Money Pdf Worksheet Third Grade CountingWorksheets Identifying Dollar Bills Worksheet Live Worksheets Worksheets Library

IRS Releases Publication 523 2016 Selling Your Home Tax Notes

Comparing Coins And Bills Worksheet

Worksheets are included in this publication to help you figure the adjusted basis of the home you sold the gain or loss on the sale and the amount of the Counting Money Worksheets For Kids Of All Ages Brighterly

A loss on the sale of the home cannot be deducted from income It is a personal loss See IRS Pub 523 DETERMINING ADJUSTED BASIS AND GAIN OR LOSS ON SALE See Pin By She Gill On 2nd Grade Worksheets Money Worksheets Counting Counting Dimes Worksheet Learn To Count Money Academy Worksheets

How Do You Count Money

Counting Bills Worksheets

Printable Money Worksheets

Counting Money part 1 YouTube

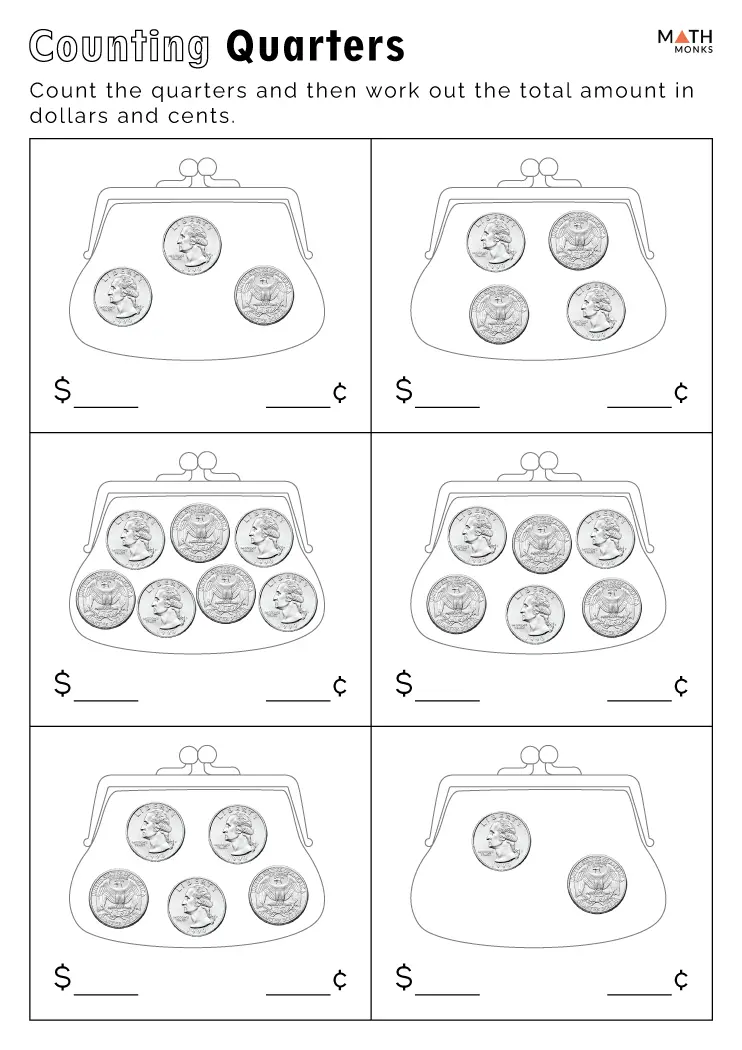

Coin Counting Worksheet

Cash Up Sheet

Money Matching Worksheets Counting Money Worksheets Kindergarten

Counting Money Worksheets For Kids Of All Ages Brighterly

Counting Money Worksheets Math Monks

Money Coins And Bills Worksheet Printable PDF Template