Children S Books For 5 7 Year Olds are a vital source for learning, organizing, and creative activities. Whether you're a teacher, moms and dad, or student, these ready-to-use resources save time and effort. From instructional worksheets for mathematics, science, and grammar to innovative templates like planners, calendars, and coloring pages, there's something for everyone. With the ease of printable layouts, finding out and productivity can be boosted in the house or in the class.

Explore a vast array of customizable designs that satisfy various needs and ages. These templates make learning interactive and fun while promoting imagination. Download, print, and start utilizing them today!

Children S Books For 5 7 Year Olds

Children S Books For 5 7 Year Olds

A collection of educational worksheets lesson plans activities and resources for teachers and parents Lesson Plans for a variety of subjects. Also find worksheets, activities, and more. Completely free for teachers to use in the classroom.

Free Lesson Plans And Activities Storyboard That

Blog 3 Varsity Vipers

Children S Books For 5 7 Year OldsPrep for class with comprehensive, teacher-created lesson plans. Ideas for differentiation mean these free lesson plans make learning fun for every student. Inspire your students with thousands of free teaching resources including videos lesson plans and games aligned to state and national standards

Discover teaching resources organized by subject area. From Math and Science to Language Arts and Social Studies, access lesson plans, worksheets, and tools to enhance your curriculum. New Books 2025 Uk 2025 Beverly R Short Taj Mahal Fact Sheet For Early Readers World Landmarks Starlight

Free Lesson Plans

Classes American Gymnastics Romeo

Quickly and easily search our database of over 400 lesson plans by keyword subject and grade level Each lesson plan includes the objective of the lesson directions and a list of resources A downloadable PDF version of each lesson is also available 50 Great Books For Toddlers Best Toddler Books Toddler Books

These lesson plan examples include pre K elementary and middle and high school in a range of subjects and styles So many smart ideas TYA EDUCATION 2024 2025 Theater For Young America Kansas City Theater Summer Camp ICodejr Academy

Tennis Camps Sutton Tennis Coaching

Funny Quotes For 11 Year Olds QuotesGram

Free 3 Old School Year Worksheet Download Free 3 Old School Year

50 Best Halloween Books For Kids Halloween Books For Kids Halloween

The 50 Best Books For 5 And 6 Year Olds Brightly Kindergarten

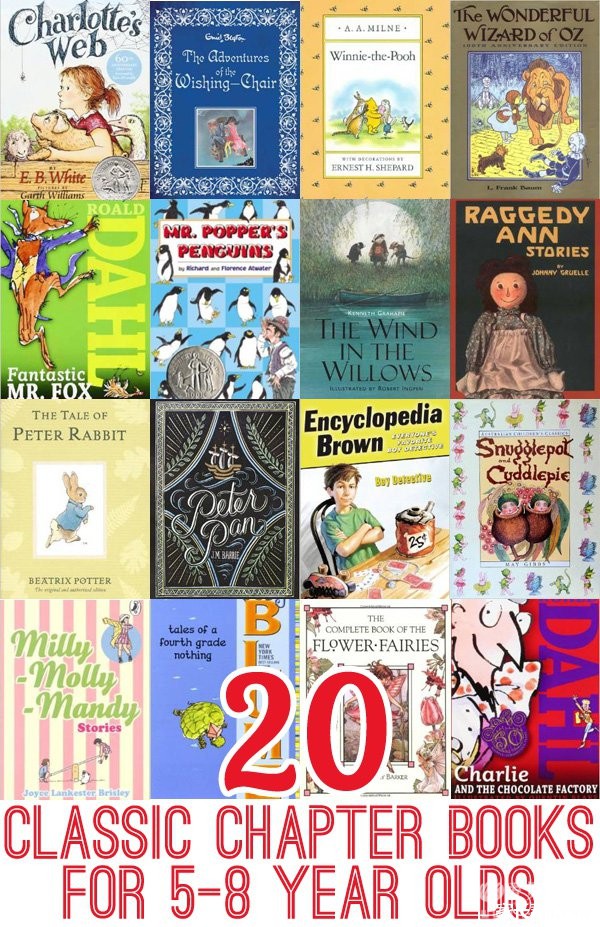

5 8 Chapter Book

50 Great Books For Toddlers Best Toddler Books Toddler Books

Steiner

1st Graders Books