Can I Get My Ged For Free In Texas are an essential resource for learning, arranging, and creative activities. Whether you're an educator, moms and dad, or student, these ready-to-use sources conserve time and effort. From academic worksheets for math, science, and grammar to imaginative templates like planners, calendars, and coloring web pages, there's something for every person. With the benefit of printable styles, finding out and performance can be boosted in your home or in the classroom.

Explore a vast array of personalized layouts that deal with numerous needs and ages. These templates make discovering interactive and fun while advertising creativity. Download, print, and begin using them today!

Can I Get My Ged For Free In Texas

Can I Get My Ged For Free In Texas

Function Operations and Composition of Functions Assignment Copyright PreCalculusCoach 1 Using and find Determine the domain of Function Operations. Perform the indicated operation. 1) g(n) = n. 2 + 4 ... Worksheet by Kuta Software LLC. 13) f (x) = 2x. 3 − 5x. 2 g(x) = 2x − 1. Find ...

Function operations and composition TPT

What Is GED And Why It Is Essential For High School Student YouTube

Can I Get My Ged For Free In TexasIn this resource, students will practice function operations (adding, subtracting, multiplying, and composition). Only prep work is to ... Function Operations Compositions If 1 2 x xf 3 2 x xg and x xh41 find the following new functions as well as any values

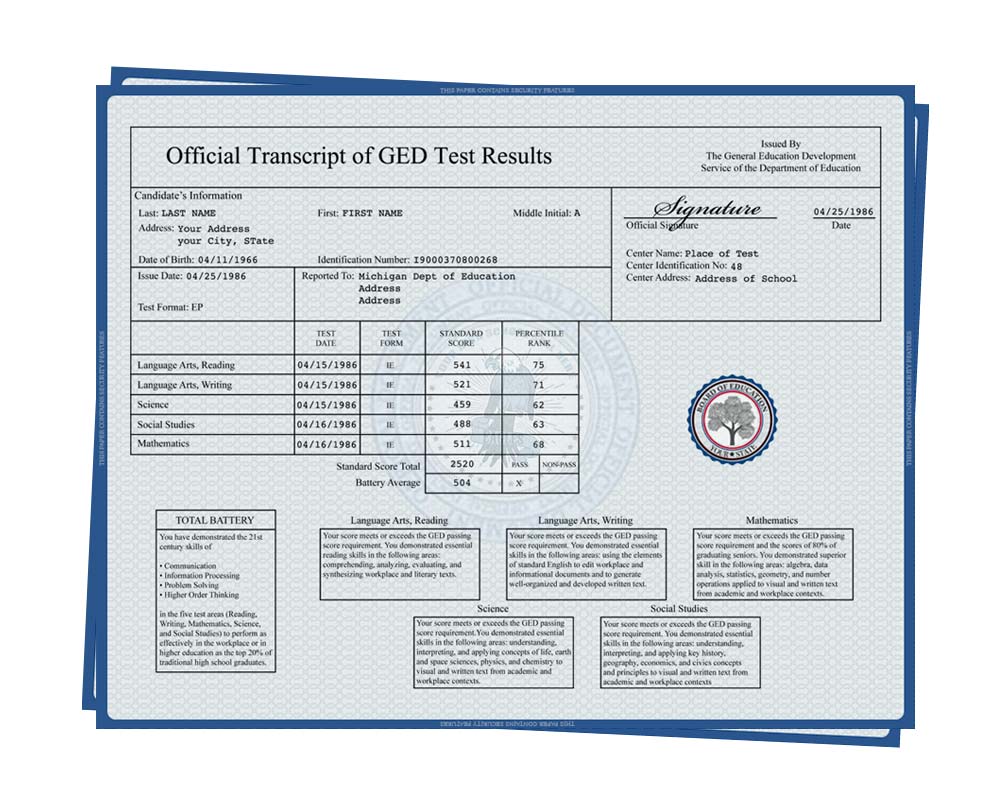

Here are Free Resources for your lesson on Function Operations and Composition of Functions Worksheet, Guided Notes, Lesson Plan, Bell Work, & PowerPoint. Fake GED Diplomas And Transcripts Starting At Only 49 Each Fake GED Diploma And Transcripts Score Sheets Realistic Diplomas

Function Operations Kuta Software

HOW TO START STUDYING FOR THE GED EXAMS First Three Steps To Pass And

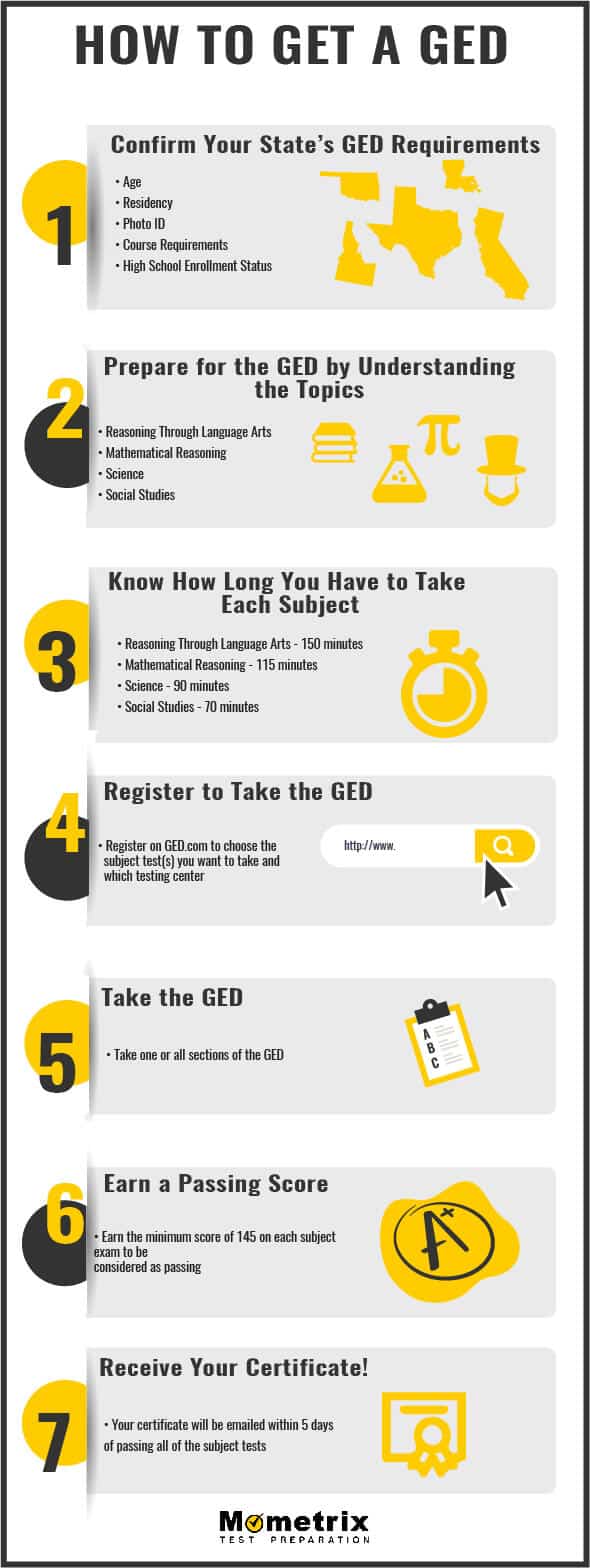

Math Functions Operations Discover a vast collection of free printable worksheets to help students master essential math skills and explore various topics in How To Get A GED

Use the tables of ordered pairs to determine the value of each composite function How To Pass The GED Writing Test Video 2 How The Writing Test Is Get Copy Ged Certificate

Ged Certificate Template

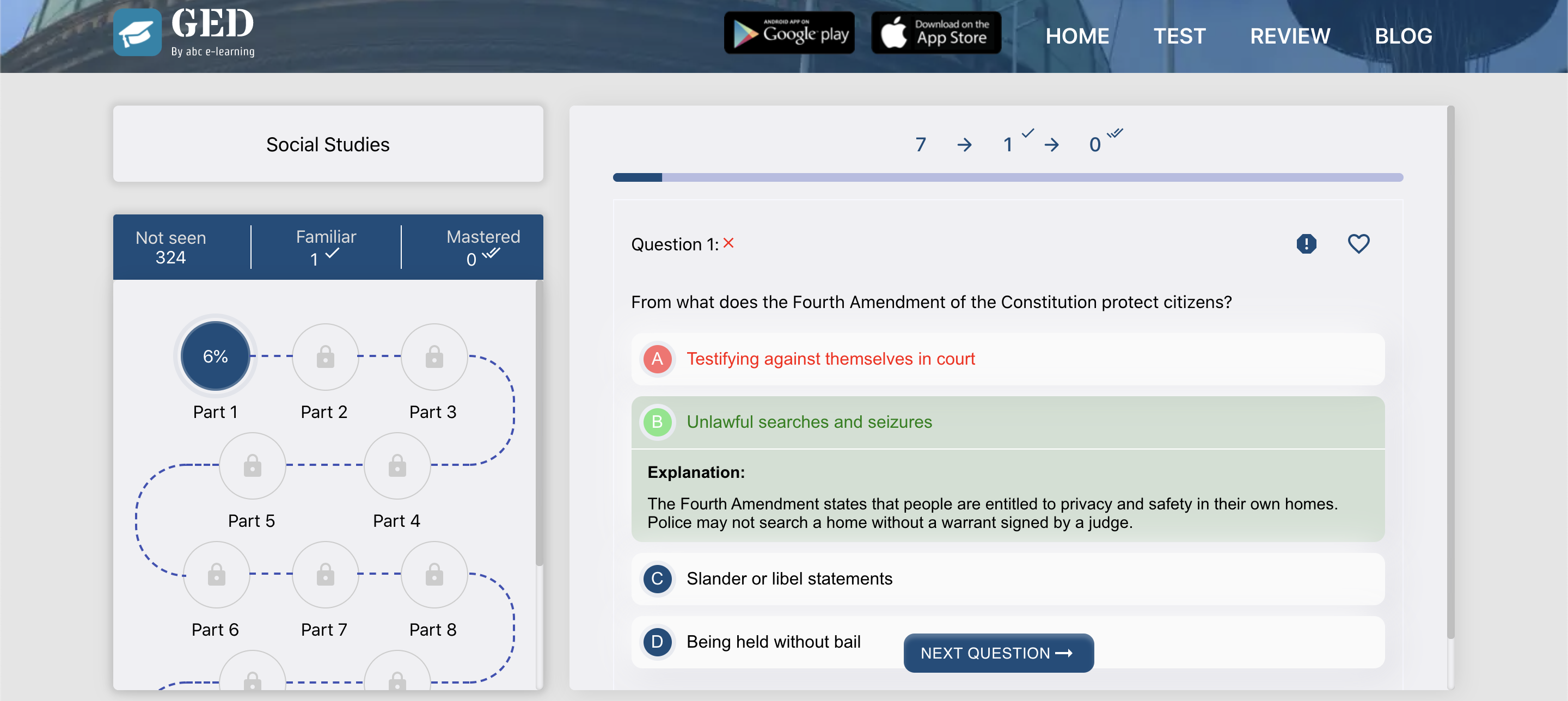

GED Social Studies Practice Test

GED

Diploma Images Photos Mungfali

Tuningpp Graduation Certificate Template Fake High School

Ged Certificate Template Best Templates Ideas

FAQs Lime Feather Learning

How To Get A GED

Get Copy Ged Certificate

Ged Test Answers 2024 Albina Tiffie