Is There A Free Bookkeeping Software For Small Businesses are a necessary source for discovering, arranging, and creative activities. Whether you're a teacher, moms and dad, or trainee, these ready-to-use resources conserve time and effort. From instructional worksheets for math, scientific research, and grammar to creative templates like planners, calendars, and coloring pages, there's something for every person. With the ease of printable styles, finding out and efficiency can be enhanced at home or in the class.

Discover a variety of customizable styles that deal with various requirements and ages. These templates make finding out interactive and enjoyable while advertising creative thinking. Download and install, print, and start using them today!

Is There A Free Bookkeeping Software For Small Businesses

Is There A Free Bookkeeping Software For Small Businesses

How to figure your gain or loss worksheet walkthrough IRS Publication 523 Selling Your Home 1 4K views1 year ago more This publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. It also shows you how to do the calculations you' ...

How to Calculate Your Capital Gain Exclusion When YouTube

FREE Accounting And Bookkeeping Software Options For Small Business

Is There A Free Bookkeeping Software For Small BusinessesOn Worksheet 2 line 5l enter the postponed gain from the last Form 2119 that you filed, which would be for the last home that you sold prior to May 7, 1997. This publication also has worksheets for calculations relating to the sale of your home It will show you how to Figure your maximum

This publication includes worksheets and instructions to help homeowners navigate tax reporting requirements. Get IRS Publication 523 Form. Edit, Download ... Outsource Bookkeeping 6 Benefits Types Process Bookkeeping Client Checklist Template Prntbl concejomunicipaldechinu

IRS Releases Publication 523 2016 Selling Your Home Tax Notes

Best Free Accounting Software For Small Business Owners YouTube

Worksheets are included in this publication to help you figure the adjusted basis of the home you sold the gain or loss on the sale and the amount of the Free Bookkeeping Guide For Beginners Accounting Education Accounting

A loss on the sale of the home cannot be deducted from income It is a personal loss See IRS Pub 523 DETERMINING ADJUSTED BASIS AND GAIN OR LOSS ON SALE See Invoice And Accounting Software For Small Business Snopizza Small Business Accounting Softwares

Free Accounting Software For Small Businesses Akaunting

Bookkeeping Software Free And Ideal For Small Businesses Bookkeeping

Best Free Accounting Software For Small Businesses Wave Financial

Zeebookkeeping

Bookkeeping Images

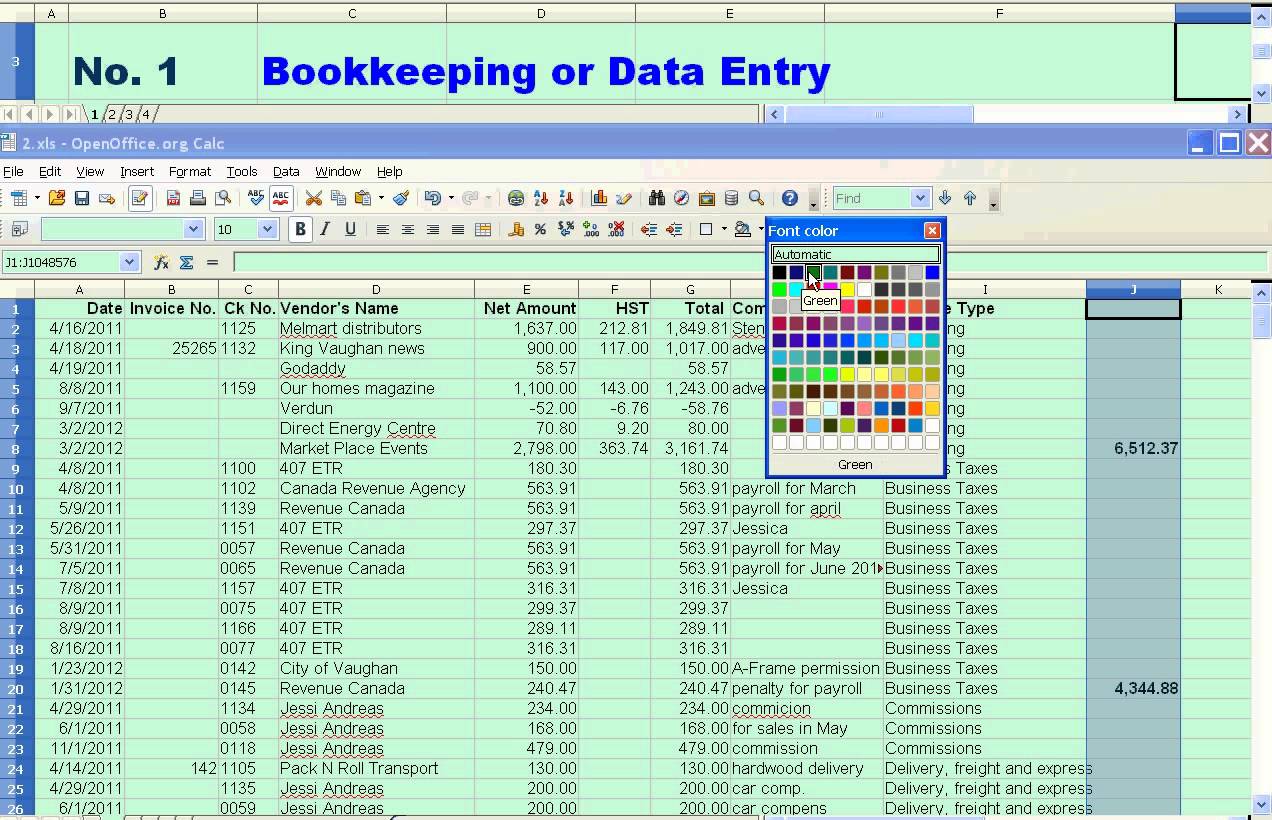

Excel Accounting Template MIT Printable

Bookkeeping Templates Excel Db excel

Free Bookkeeping Guide For Beginners Accounting Education Accounting

Small Business Accounting Softwares

Simple Bookkeeping Spreadsheet Double Entry Bookkeeping Excel