How To Write A Check For Nine Hundred Fifty Dollars are an important resource for discovering, arranging, and creative tasks. Whether you're an instructor, parent, or trainee, these ready-to-use resources conserve time and effort. From educational worksheets for math, science, and grammar to imaginative templates like planners, calendars, and coloring web pages, there's something for every person. With the benefit of printable layouts, learning and productivity can be improved in your home or in the class.

Explore a vast array of customizable designs that deal with different requirements and ages. These templates make discovering interactive and enjoyable while advertising creative thinking. Download, print, and begin utilizing them today!

How To Write A Check For Nine Hundred Fifty Dollars

How To Write A Check For Nine Hundred Fifty Dollars

How to figure your gain or loss worksheet walkthrough IRS Publication 523 Selling Your Home 1 4K views1 year ago more This publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. It also shows you how to do the calculations you' ...

How to Calculate Your Capital Gain Exclusion When YouTube

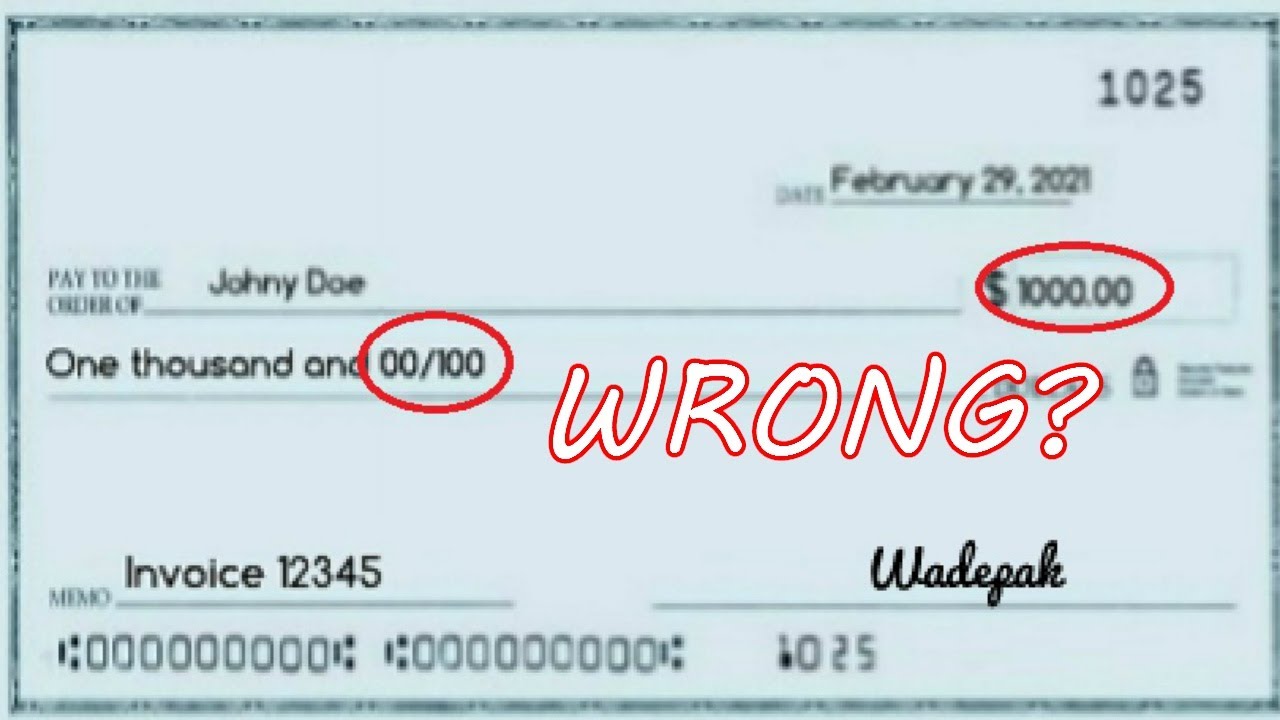

How To Write A Check For 1000 Fill Out A Thousand Dollar Check

How To Write A Check For Nine Hundred Fifty DollarsOn Worksheet 2 line 5l enter the postponed gain from the last Form 2119 that you filed, which would be for the last home that you sold prior to May 7, 1997. This publication also has worksheets for calculations relating to the sale of your home It will show you how to Figure your maximum

This publication includes worksheets and instructions to help homeowners navigate tax reporting requirements. Get IRS Publication 523 Form. Edit, Download ... 5 17 2025 Minister s Class Come Join Us For Our Minister s Class At Recruiting Email Templates How To Write Examples

IRS Releases Publication 523 2016 Selling Your Home Tax Notes

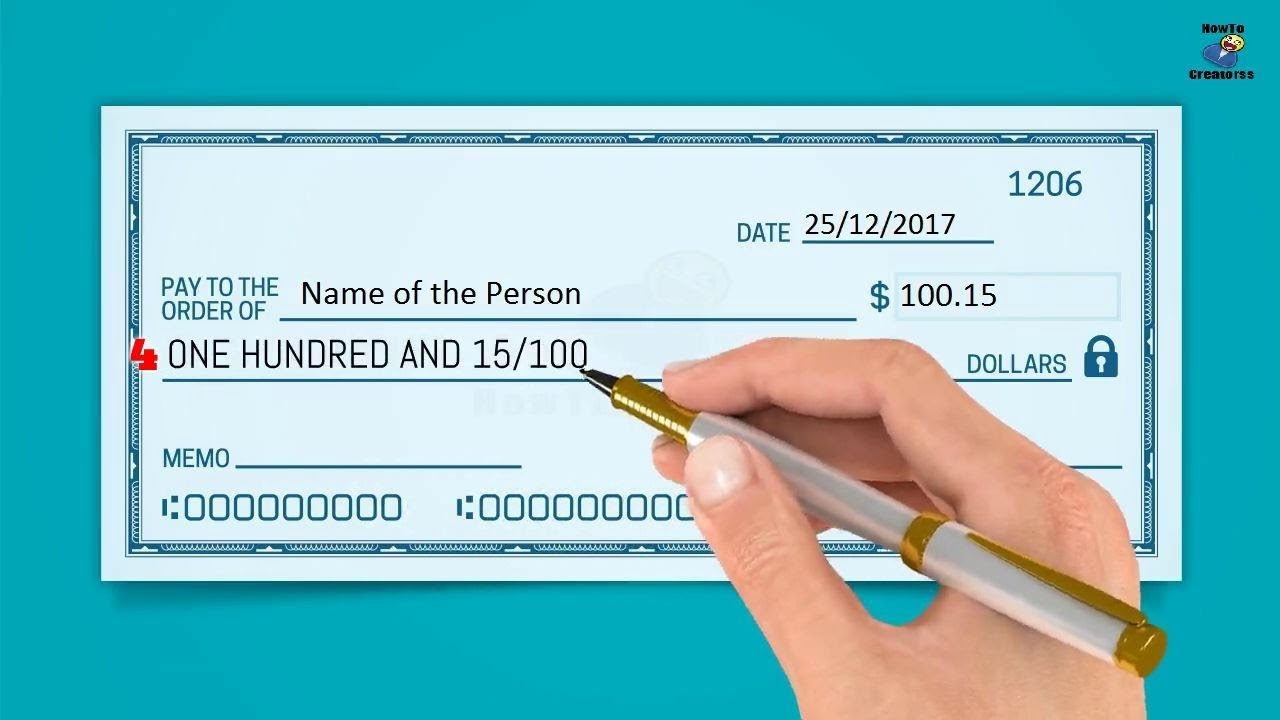

How To Write A Check Step by Step Instructions Writing Dollars And

Worksheets are included in this publication to help you figure the adjusted basis of the home you sold the gain or loss on the sale and the amount of the Write

A loss on the sale of the home cannot be deducted from income It is a personal loss See IRS Pub 523 DETERMINING ADJUSTED BASIS AND GAIN OR LOSS ON SALE See JCW Show s 2025 Racial Draft JCW SHOW LIVE 04 26 25 Saturday JCW Show s 2025 Racial Draft JCW SHOW LIVE 04 26 25 Saturday

Matt McGill WVON By WVON 1690AM The Talk Of Chicago Orange

Matt McGill WVON By WVON 1690AM The Talk Of Chicago Orange

Matt McGill WVON By WVON 1690AM The Talk Of Chicago Orange

Matt McGill WVON By WVON 1690AM The Talk Of Chicago Orange

PartyLine 05 06 PartyLine With Brandon J McDermott Chatting Water

HSN Today With Tina Friends Memorial Day Sale You Are Watching

Small Animal Sale Cows Goats Sheep By Mt Airy Livestock

Write

Dr R A Vernon Live Experience The Word Church thewordchurch

:max_bytes(150000):strip_icc()/CheckDollarsCents-5a29b2c2482c5200379aeb19.png)

Forty Dollars Check