How To Keep Track Of Income And Expenses When Self Employed are a vital source for understanding, organizing, and imaginative tasks. Whether you're an instructor, parent, or pupil, these ready-to-use sources conserve time and effort. From educational worksheets for mathematics, science, and grammar to innovative templates like planners, calendars, and coloring pages, there's something for every person. With the convenience of printable layouts, discovering and performance can be improved in the house or in the classroom.

Explore a vast array of adjustable layouts that satisfy numerous requirements and ages. These templates make finding out interactive and fun while advertising creativity. Download and install, print, and start utilizing them today!

How To Keep Track Of Income And Expenses When Self Employed

How To Keep Track Of Income And Expenses When Self Employed

Our grade 1 money worksheets help students identify and count common coins The initial worksheets review the names and values of U S coins Images use both Find here an unlimited supply of printable money worksheets for counting US coins and bills. The worksheets are highly customizable and available in both PDF ...

Money Worksheets Counting Coins Making Change

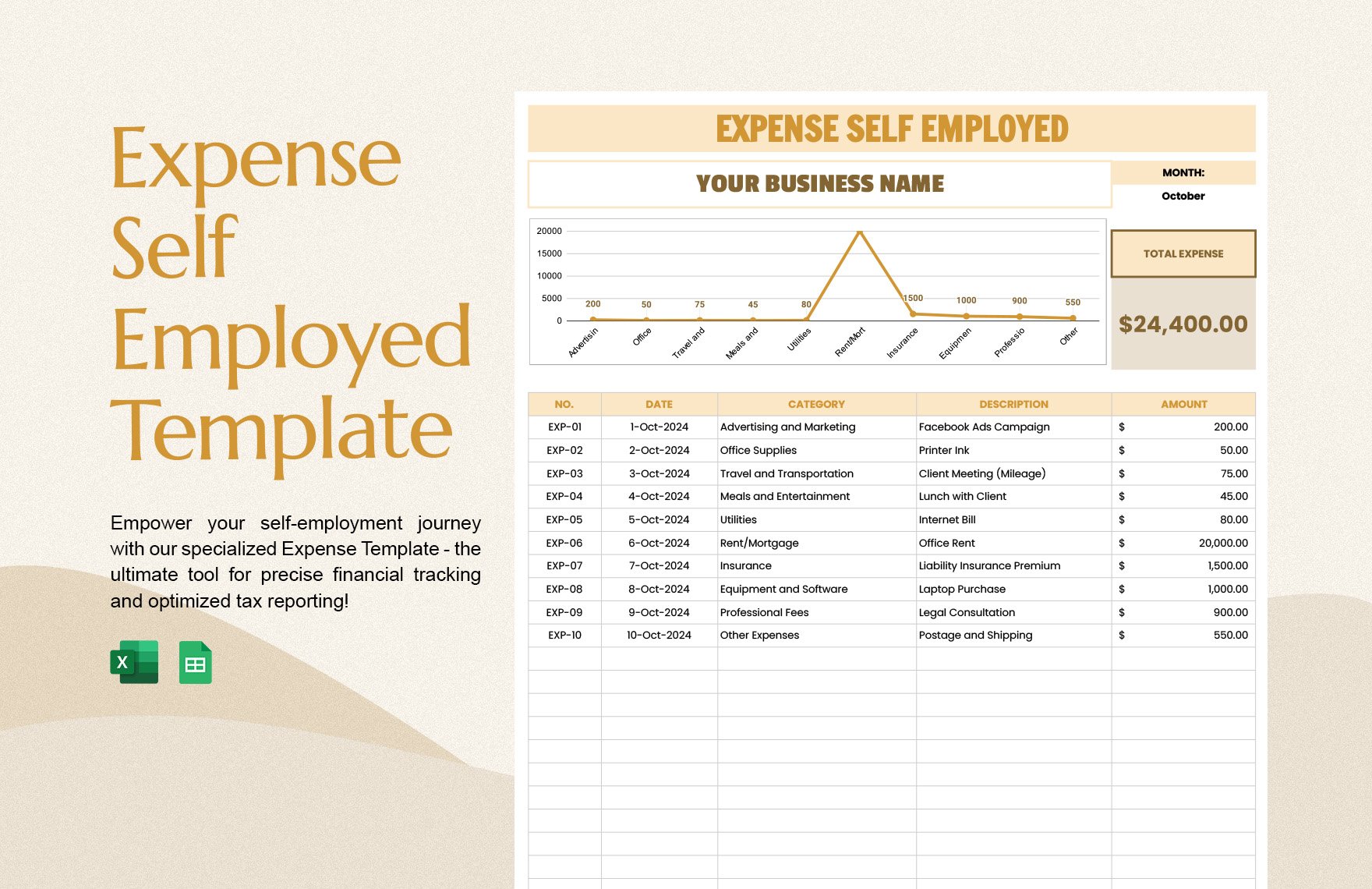

Budgeting Worksheets Spreadsheet Template Expense Tracker Excel

How To Keep Track Of Income And Expenses When Self EmployedThese Money Worksheets are great in helping children to count and recognize different money from countries around the world. Help your child learn to recognize U S dollars and coins with these printable money cut outs 1st grade Math Worksheet

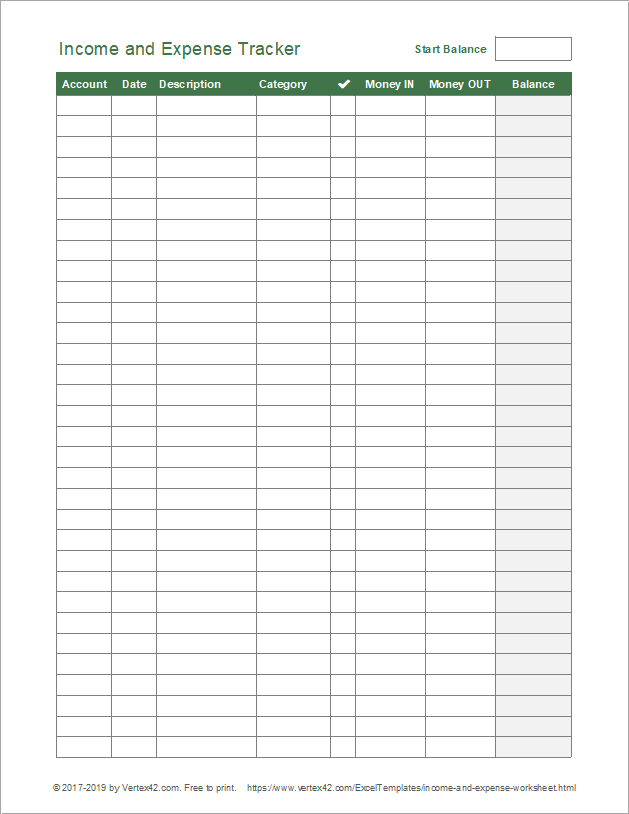

These worksheets will help kids learn about counting coins, making change, and identifying currency. The best part is that they are all free to download and ... Free Income And Expenses Worksheet Download Free Income And Expenses Excel Template For Monthly Income And Expenses Nutsrewa

Free worksheets for counting money Homeschool Math

![]()

Sigmamilo Blog

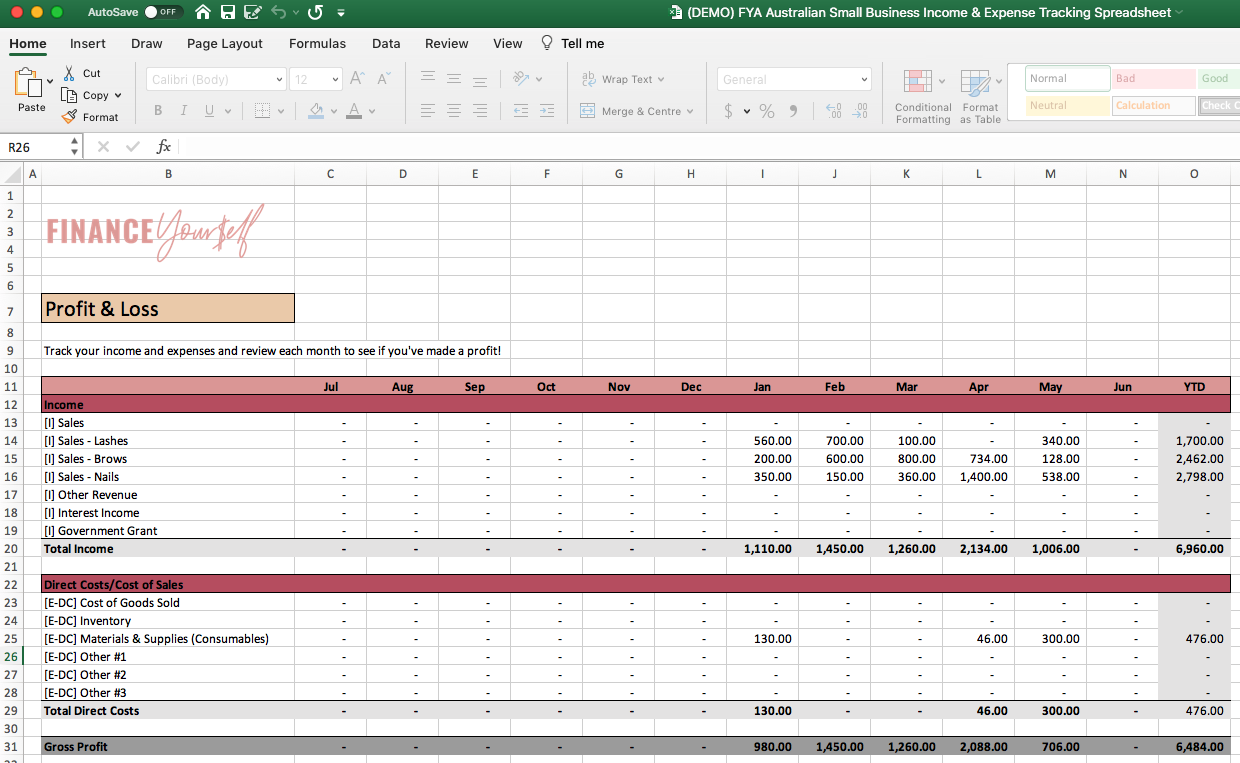

On this penny printable kids practice tracing letters counting coins and they even get to do some fun coloring too FREE Australian Small Business Income Expense Tracking Spreadsheet

7 NO PREP worksheets to help your students with pennies dimes and nickels Students will match coins to their values Church Tithe And Offering Template In Excel Google Sheets Download Tracking Sheet Excel Template

![]()

Free Business Expense Tracking Spreadsheet 2025

![]()

Income And Expense Tracker Template Download In Excel Google Sheets

Freelance Excel Perumperindo co id

Excel Template Business Income Expenses Jesmanager

Excel Spreadsheet For Business Expenses Expense Spreadsheet

Free Small Business Spreadsheet For Income And Expenses 2024

Accounts Excel Template

FREE Australian Small Business Income Expense Tracking Spreadsheet

Excel Template To Track Income And Expenses Neloengine

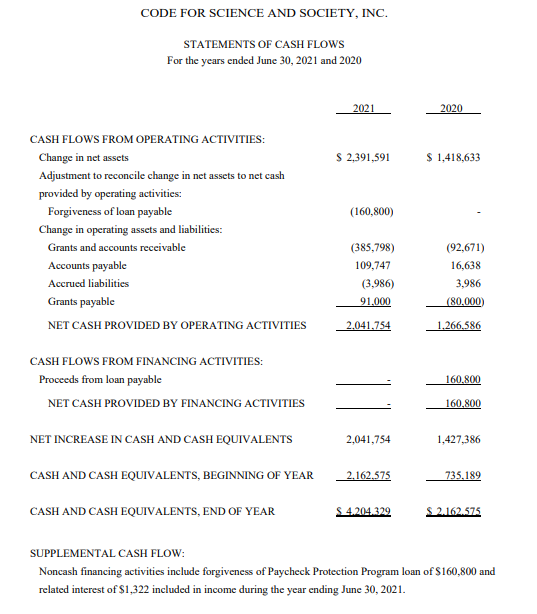

Financial Statement