Early Years Koorie Literacy And Numeracy Program are a vital resource for understanding, organizing, and innovative activities. Whether you're an educator, parent, or pupil, these ready-to-use sources conserve effort and time. From educational worksheets for mathematics, science, and grammar to innovative templates like planners, calendars, and coloring pages, there's something for everyone. With the benefit of printable styles, finding out and performance can be enhanced at home or in the class.

Discover a wide range of customizable layouts that satisfy different demands and ages. These templates make learning interactive and enjoyable while advertising creative thinking. Download and install, print, and start using them today!

Early Years Koorie Literacy And Numeracy Program

Early Years Koorie Literacy And Numeracy Program

How to figure your gain or loss worksheet walkthrough IRS Publication 523 Selling Your Home 1 4K views1 year ago more This publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. It also shows you how to do the calculations you' ...

How to Calculate Your Capital Gain Exclusion When YouTube

Project Proposal For District Roll Out Training On The Early Language

Early Years Koorie Literacy And Numeracy ProgramOn Worksheet 2 line 5l enter the postponed gain from the last Form 2119 that you filed, which would be for the last home that you sold prior to May 7, 1997. This publication also has worksheets for calculations relating to the sale of your home It will show you how to Figure your maximum

This publication includes worksheets and instructions to help homeowners navigate tax reporting requirements. Get IRS Publication 523 Form. Edit, Download ... Koorie Kids Shine Cultural Safety At Kinder Deadly Western Connections School Extension Program Narrative Report

IRS Releases Publication 523 2016 Selling Your Home Tax Notes

Junior School Literacy And Numeracy YouTube

Worksheets are included in this publication to help you figure the adjusted basis of the home you sold the gain or loss on the sale and the amount of the Our Curriculum Lidcombe Early Learning Centre

A loss on the sale of the home cannot be deducted from income It is a personal loss See IRS Pub 523 DETERMINING ADJUSTED BASIS AND GAIN OR LOSS ON SALE See Home OLNA Practice Online Literacy And Numeracy Assessment Raupe Nimmersatt Pringles Dose The Very Hungry Caterpillar Activities

LITERACY AND NUMERACY AREA FOR CLASSROOM YouTube

Koorie Pre At Narrabundah Early Childhood School YouTube

LIBRARY KV MANGALDOI

A TSI

Here s A Great Example Of A Number Station Designed For Math Play

Caribbean Rhythm Integrated Language Arts Literacy And Numeracy

Our Curriculum Lidcombe Early Learning Centre

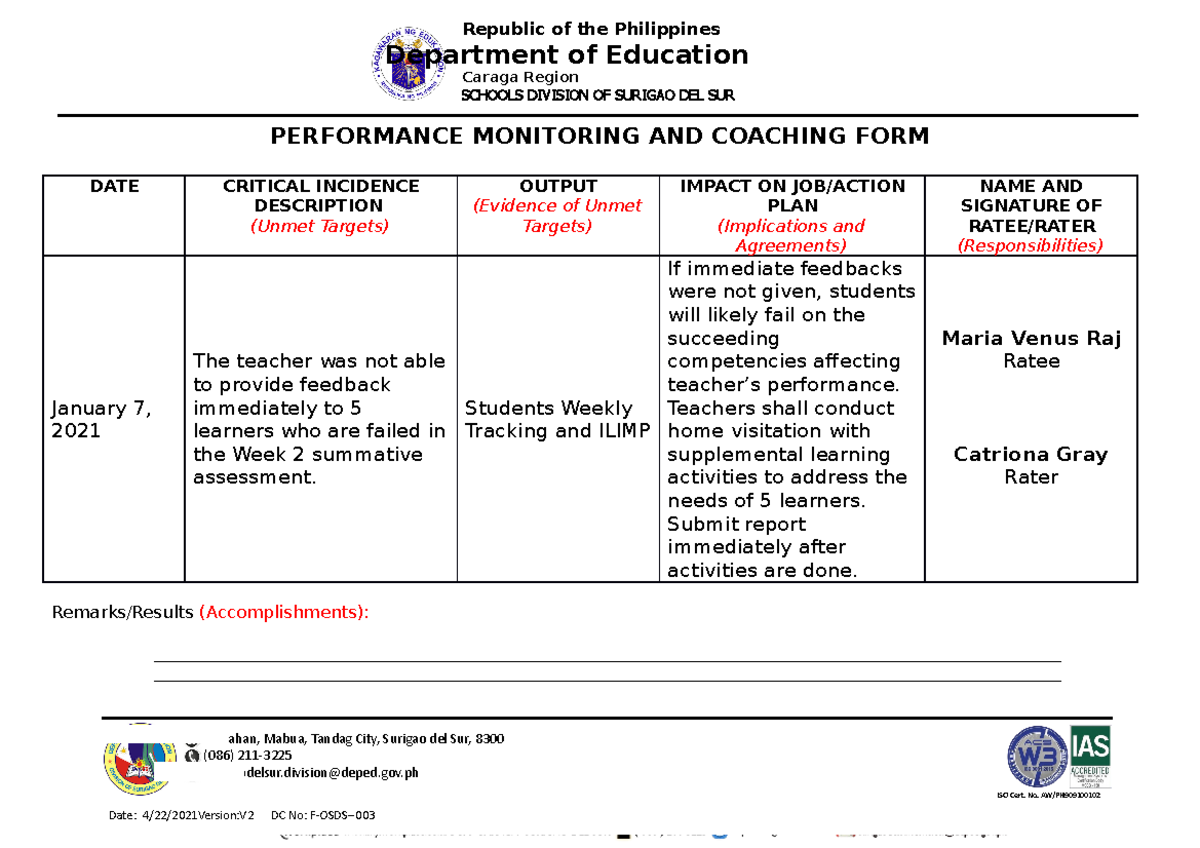

Performance Monitoring

Numeracy Skills